North Dakota County Handbook

This handbook is a living document. We are making additions frequently. Please use the suggestion box to let us know how we can improve it.

Note: to search for a specific topic, click it on the Table of Contents below or use your browser's Find feature:

- PC Users: Hold down the CTRL key on your computer and type F.

- Mac Users: Hold down the CMND key and type F.

- Mobile users: touch the three dots at the top right of your screen and select "Find in page"

Table of Contents

Section 1 – General Structure and Powers

1.01 - Organization and Structure Options for County Government

- 1.01.1Traditional County Structure

- 1.01.2County Consolidated Office

- 1.01.3County Manager

- 1.01.4Home Rule Counties

- 1.01.5Tool Chest Legislation for Local Government

1.02 - County Officers

- 1.02.1Elected Offices

- 1.02.2Elected or Appointed Offices

- 1.02.3Appointed Offices

- 1.02.4Terms of County Offices

- 1.02.5Vacancy in County Office

- 1.02.6Vacancy in Board of Commissioners

- 1.02.7Appointed Boards

1.03 - County Redistricting

Section 2 - Finance and Taxes

2.01 - Revenue Sources

2.01.1 Property Tax

- 2.01.1(a)Tax Abatements

- 2.01.1(b)Disabled Veterans Credit

- 2.01.1(c)Homestead Credit

- 2.01.1(d)Farm Residence Exemption

- 2.01.1(e)Primary Residence Credit

- 2.01.1(f) Other Exemptions

2.01.2 Other Taxes

- 2.01.2(a)Prohibited Taxes

- 2.01.2(b)Additional Taxes for Home Rule Counties

- 2.01.2(c)County Lodging Tax

- 2.01.2(d)County Lodging and Restaurant Tax

2.01.3 Intergovernmental Revenue

2.01.4 Other Revenue Sources, Charges and Fees

2.02 - Appropriations & Expenditures

Section 3 - Road & Bridge

Section 4 - Human Resources

Section 5 - Open Meetings & Open Records

5.01 - Open Meetings

5.02 - Open Records

-

5.02.1 Charging for Public Records

Section 1: General Structure and Powers

Introduction

North Dakota is divided into 53 counties. Counties are political subdivisions of state government, each organized as an incorporated body for civil and political purposes only. Counties may sue and be sued, contract and be contracted with, and purchase and hold real estate for the use of the county. The board of county commissioners is the primary policy-making body in the county and has broad authority, including adopting the annual budget and approving tax levies as well as significant appointive, administrative, and regulatory powers. The North Dakota Century Code establishes options for county government structure.

Additional Resource: History of North Dakota County Government & the ND Association of Counties

1.01 - Organization and Structure Options for County Government

Mix of Home Rule and Dillon’s Rule: In North Dakota, 12 counties have adopted a home rule charter and 41 are governed under Dillon’s Rule. A board of county commissioners may cause a home rule charter to be drafted and submitted for adoption, pending the approval by the county voters. Home rule counties have the same powers as general law counties as well as additional freedoms for establishing financial authority (including countywide sales tax) and the structure of county government, including elected and appointed officers, so long as it is not inconsistent with state law. State statute also empowers counties to adopt a multicounty home rule charter between two or more counties.

Additionally, counties have been granted through statute, the authority to restructure the statutorily elected offices (except for the sheriff). This authority can be accessed by citizen petition or commission action and can result in the combining or separating of offices or duties, as well as the redesignation of elected offices to appointed or the reverse.

Each county in North Dakota is governed by a board of 3-5 commissioners that serves as both the legislative and executive decision-making body for the county government. State law does not allow for the authority (in Dillon’s Rule counties) to create a chief executive officer position; however, counties may choose to adopt a county managership form of government which creates the county manager position. The county manager serves as the chief administrative officer and is responsible for the administration of county affairs as delegated by the board of commissioners. Depending on the form of managership adopted, county managers may be either elected by the county residents or appointed by the county board of commissioners. Home rule powers would allow the creation of a county managership through election or appointment as well.

1.01.1 Traditional County Structure NDCC 11-10-02

Each organized county, unless it has adopted one of the optional forms of county government (see below) or combined or separated the functions of county offices or redesignated offices as elected must have the following officers elected to four-year terms.

Auditor NDCC 11-13

Recorder (ex officio clerk of court in counties less than 6,000) NDCC 11-18

Treasurer NDCC 11-14

Coroner ND 11-19.1-03

Board of Commissioners (3 or 5 members) NDCC 11-11-02 and NDCC 11-11

North Dakota county commission boards consist of either three or five members voted on by the county electors.

Elected State’s Attorney (unless voters approve being appointed) NDCC 11-10-02.3 and NDCC 11-16

Elected Sheriff NDCC 11-15

Additional Resources:

Map of Board Size for ND Counties (subject to change)

1.01.2 County Consolidated Office NDCC 11-08

Any county in the state may adopt the county consolidated form of government by resolution approved by the majority of the board of county commissioners and also approved by voters at the next primary election. If approved by voters, the consolidated form of government becomes effective the first day of January after the election.

1.01.3 County Manager NDCC 11-09

Any county may adopt one of the county manager forms of government by resolution approved by the majority of the board of county commissioners and also approved by voters at the next primary election, or by petition filed with the county auditor signed by at least 10% of the qualified electors voting in last general election for office of governor, and approved by voters at the next regular primary or general election.

Powers and duties of the county manager: NDCC 11-09-12

Administrative activities county manager is responsible for: NDCC 11-09-14

The State’s Attorney (except as provided in section NDCC 11-10-02.3) and Sheriff of a county adopting any form of county managership must be elected.

1.01.4 Home Rule Counties NDCC 11-09.1

County Commissioners may propose home rule charter by motion or can be initiated by a petition signed by at least 2% of the county population.

Charter Commission must be appointed by Commissioners within 60 days NDCC 11-09.1-02

Charter must be ratified by majority vote of electors NDCC 11-09.103 and 11-09.1-04

Home Rule Charter Powers NDCC 11-02.1-05

Additional Resources:

Procedures for Implementing Home Rule

ND Home Rule Counties Adoption Date and Structure

1.01.5 Tool Chest Legislation for Local Government NDCC 11-10.2

In 1993, legislation was passed providing a process that can be initiated by the county board or the citizens of the counties to combine, separate, or redesignate county elected or appointed offices. It provides specific requirements, protections, and citizen vote options.

County Officer Combination, Separation, and Redesignation NDCC 11-10.2-01

Methods of Accomplishing Office Combination, Separation, or Redesignation NDCC 11-10.2-02

Analysis Required – Contents of the Plan NDCC 11-10.2-03

Plan Implementation NDCC 11-10.2-04

Combination or Separation of Appointive Offices NDCC 11-10.2-05

Multisubdivisions Office Combinations NDCC 11-10.3

Additional Resources:

County Office Combinations April 2024

Sample Tool Chest Resolution & Plan - Towner County

1.02 - County Officers NDCC 11-10-02

Each county, unless it has adopted one of the optional forms of county government or has used the tool chest provisions to combine or separate offices, or redesignated offices as elected or appointed, must have the following officers

1.02.1 Elected Offices

Board of Commissioners (3 or 5 members) NDCC 11-11

State’s Attorney NDCC 11-16 - elected unless otherwise provided in NDCC11-10-02.3

Sheriff NDCC 11-15

1.02.2 Elected or Appointed Offices

Auditor NDCC 11-13

Recorder NDCC 11-18

Treasurer NDCC 11-14

1.02.3 Appointed Offices

Clerk of Court (elected, appointed, or state employed) NDCC 27-05.2

Tax Director NDCC 11-10.1

Coroner NDCC 11-19.1

Job Development Director NDCC 11-11.1

Surveyor NDCC 11-20

Public Administrator NDCC 11-21

Highway Engineer NDCC 11-31

Superintendent of Schools NDCC 15.1-11

| Officers | Elected/Appointed | Mandatory/Optional |

|---|---|---|

| States Attorney | Elected | Mandatory |

| Auditor | Elected | Mandatory |

| Recorder | Elected | Mandatory |

| Treasurer | Elected | Mandatory |

| Sheriff | Elected | Mandatory |

| Coroner | Appointed | Mandatory |

| Director Of Tax Equalization | Appointed | Mandatory |

| Highway Engineer | Appointed | Optional |

| Surveyor | Appointed | Optional |

| Emergency Manager | Appointed | Mandatory |

| Veterans Service Officer | Appointed | Mandatory |

| 911 Coordinator | Appointed | Optional |

| Public Health Administrator | Appointed | Mandatory |

| Superintendent of Schools | Appointed | Mandatory |

| Public Administrator | Appointed | Optional |

1.02.4 Terms of County Offices

The four-year terms for county elected officials have changed some over the years, and multiple sections of law are involved. Overall, NDCC 11-10-05 states: “Except as otherwise specifically provided by the laws of this state, the regular term of office of each county officer, when the officer is elected for a full term, shall commence on the first of January next succeeding the officer's election…” The table below details which offices are governed by this general section of law and which have other specific start dates.

Information regarding salaries for elected county officers: NDCC11-10-10 and 11-10-10.1

| County Office | Start of Term* | ND Century Code |

|---|---|---|

| County Commissioner | 1st Monday in December | 11-10-05.1 |

| State's Attorney | January 1 | 11-10-05 |

| Sheriff | Janaury 1 | 11-10-05 |

| Auditor | April 1 | 11-13-01 |

| Recorder | January 1 | 11-10-05 |

| Treasurer | May 1 | 11-14-02 |

| Clerk of District Court(Note: 14 are state employees) | January 1 | 11-10-05 |

| Coroner (5 year term) | Janaury 1 | 11-19.1-03 |

*It is important to note that through a home rule charter or the use of the tool chest provisions of state law, counties may combine traditionally elected positions. The “Charter” or the “Plan” implementing these combinations must set out the dates of their terms and whether the position is to be appointed or elected. For offices restructured or consolidated by the home rule provisions of NDCC 11-09.1 or the tool chest provisions of NDCC 11-10.2, but remain elective, the term of office may be different if specifically established by the charter or plan approved.

1.02.5 Vacancy in County Office NDCC 44-02-04

A vacancy in any county office, other than that of county commissioner, must be filled by the board of county commissioners, other than a state’s attorney removed from office under 44-11-01. In that case the appointment is made by the commissioners with the advice and consent of the governor.

1.02.6 Vacancy in Board of Commissioners NDCC 44-02-05

When a vacancy occurs in the board of county commissioners, the remaining members of the board appoint the person to fill the vacancy from the district where the vacancy occurred.

1.02.7 Appointed Boards

The Board of Commissioners is responsible for appointing several boards and to establish their rate of compensation, except water boards who set their own compensation between $75 and $135 per day. The organization structure of the various commissioner appointed boards are determined by the statute for each board.

Additional Resources:

Appointed Board Membership Statutes

Appointed Board Membership Terms

1.03 County Redistricting NDCC 11-07

The redistricting board shall meet within three months after the official publication of the decennial census to consider redistricting. If any one district in the county varies by more than ten percent from the average population per commissioner, or if the commissioners are elected at large, the redistricting board shall redistrict the county. The redistricting board members shall include:

Chairman of Board of Commissioners

State’s Attorney

Member of largest city governing body

Township Supervisor (if more than half of townships are organized)

Citizen at Large from each city excluding largest city (if at least 3 incorporated cities)

County Auditor (ex officio member)

Additional Resources:

County Elections by District (subject to change)

North Dakota counties only have the taxing authority authorized by the state legislature but have broad jurisdiction on real property taxes. Property taxes can be levied for general purposes, an emergency fund and other specific funds, but the tax levies are limited to a rate necessary to meet budget demands. Home rule counties additionally may levy a sales and use tax as well as a restaurant and lodging tax. Counties are allowed to incur general debt and issue bonds to fund revenue-generating utilities.

2.01 Revenue Sources

2.01.1 Property Tax NDCC Title 57-15

North Dakota counties are allowed the taxing authority authorized by the state legislature and have broad jurisdiction on real property taxes. Property taxes can be levied for general purposes, an emergency fund and other specific funds, but the tax levies are limited to a rate necessary to meet budget demands.

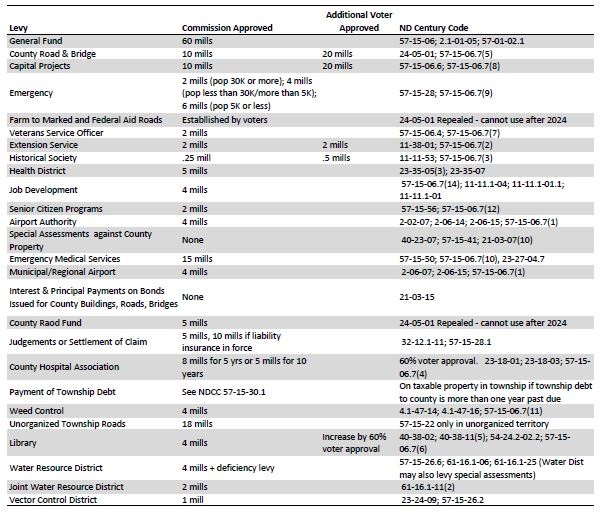

Absent a home rule charter that allows for exceeding statutory property tax limitations, county boards can levy property taxes up to a limit based on mills per dollar of taxable value. Taxable value is 4.5% of true & full value of residential property and 5% for commercial and agricultural value. Agricultural value is determined by productivity. Counties have numerous special fund levies, some of which can be increased by voter approval every 10 years. The levies counties are allowed to use can be found in the ND State Tax Department “Schedule of Levy Limitations” publication which is revised and published in July of each odd year following the legislative session. Exempt property means: property exempted from taxation as new or expanding businesses under NDCC 40-57.1; improvements to property under NDCC 57-02.2; or buildings belonging to institutions of public charity (subsection 8), new single-family residential or townhouse or condominium property (subsection 35), property used for early childhood services (subsection 36), or pollution abatement improvements (subsection 37) under NDCC 57-02-08.

The levies approved for counties are:

Additional Resources:

Determination of Levy NDCC 57-15-31

Payment and Collection of Taxes NDCC 57-20

Property Tax Deadlines in North Dakota

Property Tax Guidelines (ND Tax Commissioner)

Mill Levy Essentials Presentation

2.01.1(a) Tax Abatements NDCC 57-23

All assessments of any taxable property in excess of the true and full value are subject to correction and abatement and refund. There are two procedures for appealing an assessment (valuation).

- Informal Procedure: Property owner appeals current year's assessment by contacting local assessor and equalization board(s) before the assessment is finalized.

- Formal Procedure: Property owner appeals current or prior year's assessment by filing application for abatement and refund of taxes.

Additional Resources:

Taxpayer Assessment Appeal Process

New Assessment of Property Guidelines

2.01.1(b) Disabled Veterans Property Tax Credit NDCC 57-02-08.8

The disabled veterans credit is a property tax credit that is available to veterans of the United States armed forces with a disability of 50% or greater. If eligible, the credit may reduce the taxable value of the homestead. To qualify, veterans must meet all eligibility requirements and file an application with the local assessor or county director of tax director, which is due by February 1 of the year in which the property is assessed and for which the credit is requested.

Eligibility Requirements:

1. You must be a disabled veteran of the United States Armed Forces with an armed forces service-connected disability of 50% or greater in the year for which your application is made.

2. You must have received an honorable discharge or be retired from the United States Armed Forces.

3. You must reside on and have an interest in the property.

Additional Resources:

Application for Disabled Veterans Property Tax Credit

Guidelines for Disabled Veterans Property Tax Credit

Disabled Veterans Credit Brochure

2.01.1(c) Homestead Property Tax Credit NDCC 57-02-08.1

The homestead property tax credit is a North Dakota property tax credit that reduces the property taxes of eligible individuals. Homeowners must apply for a property tax credit with their local assessor or county director of tax equalization by March 31 in the year in which their property is assessed and the credit is requested. Eligibility requirements:

- Individuals who are 65 years of age or older, or individuals who are permanently and totally disabled

- And if your income is $70,000 or less per year

Additional Resources:

Application for Homestead Property Tax Credit

Guidelines for Homestead Property Tax Credit

2.01.1(d) Farm Residence Exemption NDCC 57-02-08(15)

A residence is eligible for exemption from property tax as a farm structure under N.D.C.C. § 57-02-08(15)(a) if all of the following conditions apply:

• It is located on agricultural lands.

• It is part of a farm plant.

• It is used to provide housing for an employee who is paid wages as a farm worker.

The application must be filed on or before February 1 of the year for which the exemption is being requested with the assessor’s office for the county where the farm residence is located.

Statement of Farm Gross Income

If an exemption is being applied for under the active farmer requirements, the individual occupying the residence must complete a Statement of Farm Gross Income to show compliance with the farm gross income requirement in one of the two calendar years preceding the year for which the exemption is being requested.

Additional Resources:

Application for Farm Residence Property Tax Exemption

2023 Statement of Farm Gross Income

2022 Statement of Farm Gross Income

2.01.1(e) Primary Residence Credit NDCC 57-02-08.10

The Primary Residence Credit (PRC) was established during the 2023 Legislative Session under House Bill 1158. The credit provides all North Dakota homeowners with the option to apply for a state property tax credit through the North Dakota Office of State Tax Commissioner. Homeowners with an approved application may receive up to a $500 credit against their 2024 property tax obligation. To be eligible for the credit, you must own a home (house, mobile home, town home, duplex, or condo) in North Dakota, and reside in it as your primary residence. There are No Age Restrictions or Income Limitations for this credit. Only one Primary Residence Credit is available per household.

Primary Residence Credit Application

Primary Residence Credit Brochure

2.01.1(f) Other Exemptions

Application for Tax Exemption for New or Expanding Businesses

Application for Senior Citizens and Totally Disabled Renters Property Tax Refund

2.01.2 Other Taxes

2.01.2(a) Prohibited Taxes for Counties

Counties are prohibited from imposing certain taxes as follows:

- Personal Property Tax

- Income Tax

- Mineral Tax

- Gas/Fuel Tax

2.01.2(b) Additional Taxes for Home Rule Counties NDCC 11-09.1-05

Home Rule Counties may impose certain taxes if ordinance to do so is approved by voters.

- Sales & Use Tax

- Farm Machinery Gross Receipts Tax

- Alcoholic Beverage Tax

- County Lodging Tax

- County Restaurant Tax

- Restaurant & Lodging Tax

- Infrastructure Fee

2.01.2(c) County Lodging Tax NDCC 11-09.2-01

All counties may impose a county Lodging Tax, not to exceed 2% upon the gross receipts of retailers on the leasing or renting of hotel, motel, or other accommodation – but not within an incorporated city levying a lodging tax. Proceeds are deposited into the county’s visitor promotion fund.

2.01.2(d) County Lodging and Restaurant Tax NDCC 11-09.2-02

In addition to the tax under section 11-09.2-01, the board of county commissioners of any county, by ordinance, may impose a county tax, at a rate not to exceed one percent, upon the gross receipts of retailers on the leasing or renting of hotel, motel, or other accommodations within the county for periods of fewer than thirty consecutive calendar days or one month and upon the gross receipts of a restaurant from any sales of prepared food or beverages, not including alcoholic beverages for consumption off the premises where purchased, which are subject to state sales taxes.

2.01.3 Intergovernmental Revenue

Revenue from the State of North Dakota

The Office of ND State Treasurer distributes a variety of funds to counties on a monthly, quarterly and annual basis.

Detailed information on the distributions performed by the State Treasurer.

State Treasurer Historical Distribution information.

- Coal Conversion - monthly

- Coal Severance - monthly

- Disabled Veterans Credit - annually

- Electric Distribution – annually

- Electric Generation - annually

- Electric Transmission - annually

- Game & Fish PILT

- Highway Tax - monthly Highway Tax Flow Chart

- Homestead Credit - annually

- Oil & Gas Production Tax – monthly

- Senior Mill Levy Match Grant - annually

- State Aid Distribution - monthly Link to: State Aid Flow Chart

- State Aid to Public Libraries - annually

- Telecommunications Tax - annually.

- Township Road Distribution - quarterly

- Wind Turbine Tax

Additional Resources:

ND State Tax Department's Red Book - An Overview and Comparative Guide

2022 Red Book PDF Format (printable)

Federal Government Revenue

- Flood Control - monthly Flood Control funds are distributed by the State Treasurer to counties from lease receipts for the Corp of Engineers and US Fish and Wildlife for acquired lands, flood control, navigation and allied purposes pursant to: US Code, Title 33 Navigation and Navigable Waters; 33USC701C3.

- Mineral Royalties - quarterly. Resulted from SB2202 in 1999 session. Distributed by the State Treasurer, payment for 1/2 of the State's portion of mineral royalties produced on federal land per county.

- Taylor Grazing - annually Taylor Grazing is distributed by the State Treasurer for rents on federal lands. Payment is based on number of acres of Taylor Grazing Act land per county in proportion to total amount of Taylor Grazing Act land in the state.

2.01.4 Other Revenue Sources

- Licenses, permits, fees

- Interest Income

- Charges for Services

2.02 Appropriations & Expenditures

2.02.1 Annual County Budget

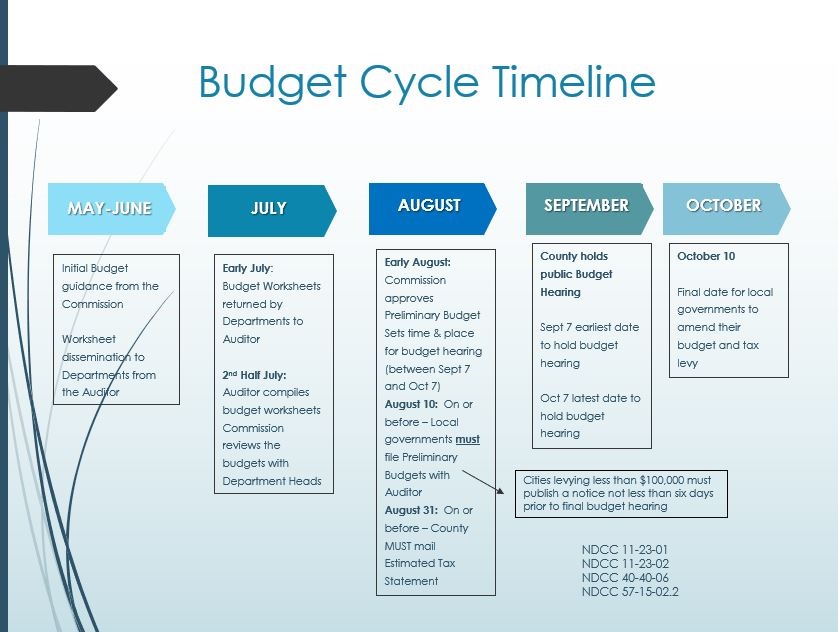

North Dakota County budget structure is dicated by NDCC 11-23.

-

11-23-01 mandates that department heads submit an itemized budget as prescribed by the state auditor.

-

11-23-02 mandates that the Auditor prepare an itemized budget of expenditures as prescribed by the state auditor for the general and all other funds

-

The budget must set forth specifically:

-

The detailed breakdown of the estimated revenues and appropriations requested for each fund for the ensuing year.

-

The detailed breakdown of the revenues and expenditures for each fund for the preceding year.

-

The detailed breakdown of estimated revenues and expenditures for each fund for the current year.

-

The transfers in or out for each fund for the preceding year and the estimated transfers in or out for the current year and the ensuing year.

-

The beginning and ending balance of each fund or estimates of the balances for the preceding year, current year, and ensuing year.

-

The tax levy request for any funds levying taxes for the ensuing year.

-

The certificate of levy showing the amount levied for each fund and the total amount levied.

-

The budget must be prepared on the same basis of accounting used by the county for its annual financial reports.

-

The amount of cash reserve for the general fund and each special revenue fund, not to exceed seventy-five percent of the appropriation for the fund.

-

Each county will have their own variation of their budget structure but at a minimum they must meet the above requirements.

Additional Resources:

County Budgeting 101 presentation

NDACo's Annual Auditor's Budget Memo

Sample Budget Policy - Cass County

Sample Budget - Stutsman County 2022

Budget Form - State Auditor's Office (scroll down to bottom of page "Annual Budgets")

2.02.2 Purchasing & Procurement

The County Board of Commissioners is given thirty powers in NDCC 11-11-14. The vast majority of those powers have to do with the overall duty to "superintend the fiscal affairs of the county" as described in NDCC 11-11-11(1). Among the powers granted to Commissioners regarding the fiscal affairs of the county, NDCC 11-11-14(4) provides that the board of commissioners are "to control the finances, to contract debts and borrow money, to make payments of debts and expenses, to establish charges for any county or other servies, and to control the property of the county."

Additional Resources:

County Bid Requirements Quick Reference

OMB Fiscal Policies and Guidelines

2.02.3 Accounting Methods

2.02.4 Bonds and Debt NDCC 21-03

NDCC 21-03-04 Grant Power to Borrow - General Limitations of Indebtedness

NDCC 21-03-06 Puposes of specific limitations of bond issues.

NDCC 21-03-07 Election Required - Exception.

NDCC 21-03-20 Execution of Bonds

NDCC 21-03-23 Bond Record

NDCC 21-03-38 Bond Proceeds - Kept in separate fund - Protection of purchaser

NDCC 21-03-41 Sinking Funds - Duty of the county treasurer

Borrowing Options for Counties

Section 3 - Road & Bridge

Section 4 - Human Resources

Section 5 - Open Meetings & Open Records

ND Attorney General's Office website for Open Meetings and Open Records: includes guides, manuals, templates, opinions, sample forms, and sample meeting notice.

NDACo Open Records & Meetings slides June 2023

5.01 Open Meetings

5.02 Open Records

5.02.01 Charging for Public Records

-

NDCC 44-04-18(2) Allows public entities (counties) to charge to redact confidential information from any records. The first hour is free and $25/hour after the first hour.

-

NDCC 44-04-18(3). Automation of public records cannot erode the right of access to those records.